Science fiction is appropriately credited for inspiring much of the modern world. Charles Townes invented the laser after reading the 1926 sci-fi novel, The Garin Death Ray. Seventeen years after the first laser demonstration, George Lucas popularized the concept with blasters and lightsabers. Star Wars also extended the sci-fi tradition of intelligent robots—complete with reason, feelings, and voice modulations—helping pave the aesthetic visions for today’s AI agents. Many of today’s most well-known entrepreneurs, from Elon Musk to Palmer Luckey, cite their early exposure to the genre for motivating their technological pursuits.

While a straight line can be drawn from sci-fi to many of humanity’s most important inventions, definite futurism can constrain people’s imaginations as much as it inspires them. In the past decade alone, tens of billions of capital have been sunk into seductive, yet narrow and futile visions of technology. For instance, 3D printing startups, which collectively raised $10B in the past decade, have nearly all failed. This is a massive investment for a $16B, 40-year-old industry.

3D printing isn’t the only deeptech category littered with skeletons. Electric vertical takeoff and landing (eVTOL) vehicles, single-stage-to-orbit (SSTO) spaceplanes, and humanoid robots all hold too many failed companies, project overruns, and burned capital to count.

There are many failure modes for such investments. The technology might be immature or the physics never checked out at all. Perhaps customers weren't ready or margins couldn’t scale. The final failure is often overdetermined, with multiple culprits to blame.

But why does this phenomenon happen so often in deeptech—and certain categories especially? This problem recurs across many technologies and industries. It is not privileged to any particular market cycle; failed attempts at commercializing flying cars have existed since at least the 1930s. It cannot be blamed on the “untechnical,” for countless PhD-holding founders, investors, and government contract officers have fallen prey to its wrath.

This essay explores what I believe to be the root cause of such pervasive misevaluations: the neglect of atomic transactions—the singular, concrete, real-world “job to be done” and its associated economics. For instance, 3D sheet metal printing boils down to printing metals of particular ASTM codes; air taxis to airport-to-heliport travel; SSTO spaceplanes to payload delivery from ground station to space station. Atomic transactions are the specific units of work the technology accomplishes once deployed in the real world, not as a working prototype in the lab.

The atomic transaction is often glossed over in favor of abstract gains in technological efficiency. Countless pitch decks brag about their new tech completing process X more efficiently. However, process X is rarely presented in concrete, real-world terms. For instance, the air taxi company Joby claims its vehicle can cover “99% of all trips taken today across New York City's five boroughs.” This is true if “trips” are defined as where the air taxi can fly and land, based on its size & range.

Yet, regulations and available infrastructure prevent them from traveling where they please. The only route eVTOLs can fly in NYC is between JFK and the Downtown Manhattan Heliport. Of course, regulations can be changed, vertiports can be built, but this is no small task—as evidenced by years of consistent delays on launch timelines from every air taxi company.

Abstract promises of technological efficiencies are often paired with claims of improved unit economics. However, unit economics depends on operational context. Net margins shrink when variables like heliport landing fees ($40->$100 per ride) and ride insurance are considered. This is similar to differences between ‘theoretical yield’ vs. ‘actual yield’ in chemistry or ‘Rpeak’ vs. ‘Rmax’ in supercomputing — real gains can fall significantly short of theoretical returns. Net margins, not gross margins, are what matters.

For a new technology to persist and scale without government or VC subsidies, it must improve the atomic transaction on cost, quality, or some other fundamental dimension. This is easier to assess in certain areas, such as energy or materials. Successful examples include China’s early bet on lithium iron phosphate batteries (safer, cheaper, and continuously shrinking energy density gap compared to lithium nickel-cobalt batteries), titanium (superior strength, weight, and corrosion-resistance compared to aluminum and steel), and the development of ever-better solar cells. Other technologies require deeper analyses; many synthetic biology companies fell into the biofuel hype-cycle of the 2000s and subsequently failed when unit economics improvements were unable to scale from lab to production. The ones that survived pivoted to lower-volume, higher-margin products.

Many in deeptech forget that the difference between a technology and a technology business is that businesses exist outside of the lab, in the real world. This oversight is especially tempting for technologies common in sci-fi, as even sophisticated technologists get distracted by the promise of what could be, instead of what is. A close examination of the ‘atomic transactions’ of air taxis will demonstrate this mistake in action—and its consequences.

Why We Don’t Have Flying Cars

The absence of flying cars is often used to illustrate a broader cultural decline in technological ambition—from Peter Thiel’s quip “We wanted flying cars, instead, we got 140 characters” to J. Storrs Hall’s Where Is My Flying Car? I am deeply sympathetic to this point of view, yet cultural stagnation and political red tape did not stop billions from being invested in flying cars in recent years. I will briefly diagnose why and then employ atomic transactions in this context.

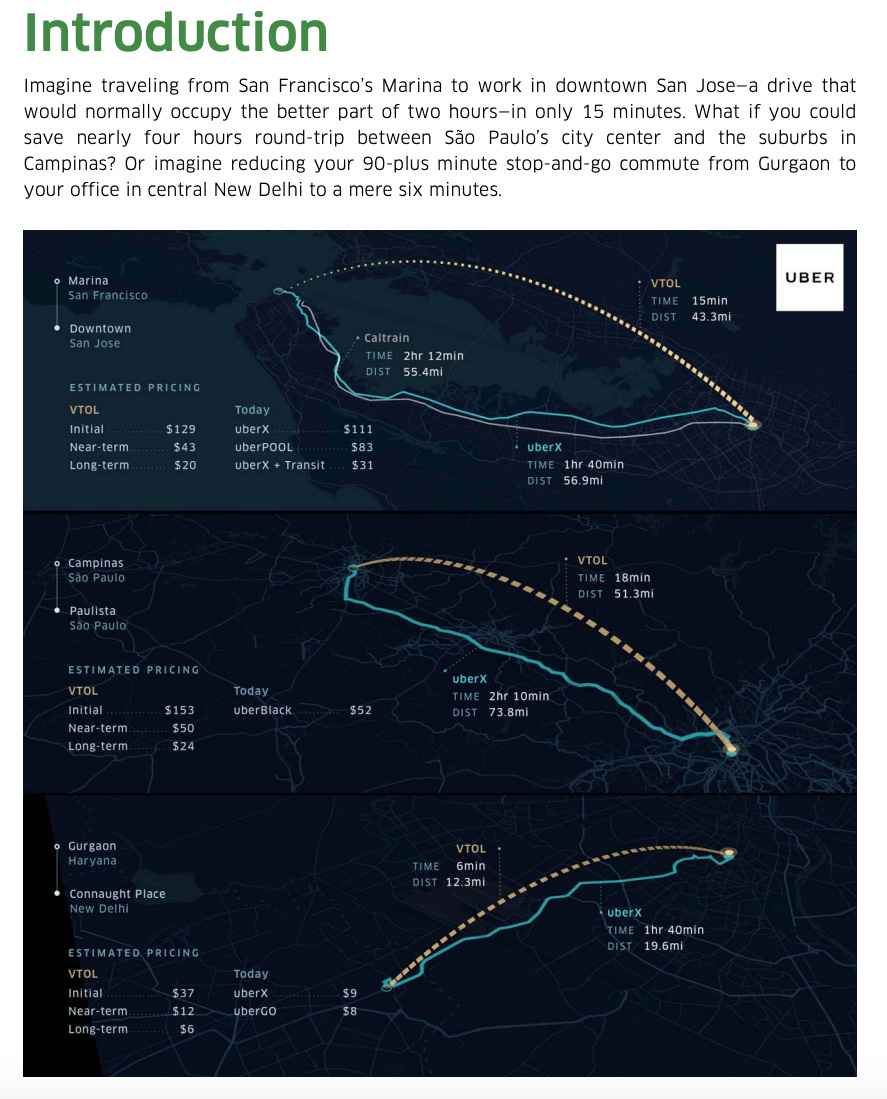

Although flying cars have been around since at least the 1930s, bullish sentiments peaked between 2016-2020. Predictions of their widespread use as ‘air taxis’ by 2025-30 were plentiful, including a widely-cited 2016 Uber whitepaper. Billions in funding flowed to Volocopter, Aeromobil, Larry Page’s Kitty Hawk, and dozens of other startups, while incumbents like Boeing and Airbus invested significant resources to develop or acquire similar capabilities.

Such renewed optimism was understandable at the time. Maturing battery technology made long-range eVTOLs feasible in pilot demonstrations. Funding was cheap at the peak of ZIRP. Air taxi startups founded a few years earlier, like Aeromobil and EHang, announced their first production vehicles and were nearing initial launch. Others, such as Terrafugia and Aurora Flight Sciences, were recently acquired—signaling market recognition from established companies. Most importantly, the travel benefits were too enticing, as Uber described on the first page of their whitepaper:

Just four years later, Uber offloaded its eVTOL division to Joby in late 2020. Kitty Hawk and AeroMobil shut down in 2022/2023. As of Aug 2024, Lilium ($LILM), Archer ($ACHR), and Joby ($JOBY) are down 94%, 64%, 54% since their 2020 IPOs. Chinese Ehang ($EH) is trading at -88% of its 2021 peak. Volocopter, Airbus, Boeing, and the surviving companies now promise commercial launch in the “next few years,” a delay from the “next few years” of yesteryear.

Neglecting the atomic transaction was the underlying mistake of the 2016-2020 cycle. Companies operated under the faulty premise that technology, not economics, was the principal challenge to overcome. Uber’s dreams of slashing the SF Marina-San Jose commute vanished as companies realized there are only a few routes in the world where such vehicles are allowed to fly at all. Even scarcer are routes with enough traffic volume to justify business operations, such as JFK-Manhattan Heliport and Heathrow-Battersea Heliport.

Even if more routes existed, the economics remain unclear. Air taxis must meet a certain revenue-per-seat threshold to justify high R&D and operating costs (e.g., heliport fees, insurance), limiting the customer base to corporate executives willing to pay far more than alternatives like Uber for marginal time savings. Moreover, many routes may be just as fast, if not faster, by car. For instance, traveling from airport to hotel by air taxi would involve taking an eVTOL from the airport to a city heliport, then transferring to a car to complete the ‘last mile’ to the hotel.

Given the regulatory, infrastructure, and cost structure realities of operating air taxis, it is highly uncertain whether there are enough atomic transactions—real routes A to B where air taxis are allowed, outperform alternatives, and attract enough customers—that make such companies feasible. This may change in the long run as eVTOL technology advances and regulations evolve. However, in the short term, many dollars were spent chasing limited atomic transactions with unrealistic commercialization timelines. As the Kitty Hawk CEO admitted, their technological achievement was “magical,” but they “could not find a path to a viable business.”

It would be inaccurate to suggest these companies ignored policy uncertainties or business viability entirely. However, the general consensus was that the technology question was upstream of other hurdles. If they could just get the tech to work, the benefits would be so obvious that customers would clamor for it, regulators would ease restrictions, the market would 100x, and the unit economics would just work. After all, Uber and Lyft successfully executed this playbook in the rideshare market.

However, air taxis and ridesharing operate with vastly different political economies—a contrast that becomes evident at the atomic transaction level. Although promised to be affordable, early air taxis are more akin to private jets than ridesharing due to their necessarily high initial prices. As a result, their customer base—and corresponding lobbying power—is much smaller than that of Uber or Lyft. Conversely, while the taxi lobby was powerful in many cities, its influence pales compared to potential public backlash over the perceived risks of large, luxury aircraft falling from the sky. For regulators, the political fallout from an air taxi accident is far scarier than upsetting the taxi lobby. They will accordingly be more cautious and risk-averse to updating policy (as history has proven). A better comparison is supersonic flight, whose atomic transactions and corresponding economic/regulatory implications share structural similarities to air taxis.

Several strategies can be adopted if a technology’s atomic transaction proves unviable as a business. Four are discussed below.

The first is to pivot to a different problem better suited to the technology’s first-principles advantages, thereby alternating the atomic transactions at play. This is ideally done at the company ideation phase, but in sci-fi-captured deeptech categories like flying cars, it’s easy to get distracted by popular notions of what these technologies ‘should be used for.’

Take Jump Aero, which is building an eVTOL for first responders. If the primary purpose of an aircraft is to travel faster than alternative modes of transport, one should consider where time is most valued in transportation. Outside of business travel, it is emergency response (e.g. combat medic or disaster relief), where a few minutes can mean the difference between life and death.

The use case drives the technology and business model. Many in sci-fi-captured deeptech categories have this backward. Flying cars for urban transport vs. first response have completely different atomic transactions. Air taxis optimize for $ per passenger and passengers per day, so maximizing battery capacity, seat capacity, and time-in-air is critical. In contrast, first responder vehicles are mostly spent in downtime. Instead, what matters is maximizing the speed of deployment within limited distances, minimizing re-deployment friction, and other variables not relevant to air taxis.

The second is to increase net margins by growing revenue or lowering costs. Airbus quadrupled potential marginal revenue by shifting from a one-seater to a four-seater model. Wisk, a Kitty Hawk-spinout later acquired by Boeing, abandoned piloted eVTOLs completely in favor of unmanned vehicles. This allows one additional paying customer while reducing pilot training, availability, and certification requirements, thereby lessening operating costs. Of course, this raises R&D burdens, but hey, the good folks at Boeing are known for their technical acumen.

The third is to expand the market size (the real market of atomic transactions, not a hypothetical TAM). For air taxis, this involves addressing the main constraints: regulations and pickup/dropoff infrastructure. On the former, Wisk based itself in New Zealand due to its friendly regulatory environment for trialing unmanned eVTOLs (e.g. allowing beyond-visual-line-of-sight testing). If they successfully establish unmanned eVTOL rules in NZ, they have a strong case for other governments to follow in their footsteps, expanding the jurisdictions for autonomous eVTOL transport. On infrastructure, Volocopter initially made developing “veriports” (micro landing zones for eVTOLs) central to their product/GTM strategy, although they recently removed it from their website, perhaps to cut costs due to potential insolvency.

The latter two options are harder and costlier than the first. In the case of air taxis, so much of the product and economic constraints are intractable properties of the market itself. If one wishes to build a flying car company, one should first find problems where the margins work, not just the technology.

Fourthly, one may subvert the technology entirely by solving for distribution. Blade is building a dominant consumer brand in private/semi-private aviation, starting with charted helicopters and seaplanes on congested or popular ground routes. Once eVTOLs reach maturity, Blade can leverage its network density and consumer brand advantage to launch an air taxi business with a robust distribution network on day one (they used this strategy to quietly become America’s largest organ transport business).

Limitations

There are some caveats worth noting about atomic transactions.

First, many technologies cannot be reduced to atomic transactions. Applying this framework to the original iPhone in 2007 may have led to the conclusion that the atomic transaction for phones was calling or texting between persons A to B, with multi-touch display viewed as a marginal improvement.

Atomic transactions should only be applied when a technology’s application has narrow limits where clear mappings exist—between inputs and outputs, supply and demand, action and result. In the case of flying cars, the “job-to-be-done” is simple: transporting people from A to B more efficiently than alternatives. This logic fails for the iPhone, whose radical innovations enabled entirely new behaviors and applications—many of which were impossible to foresee before its launch.

How precisely one can predict customer demand for a new technology is a fiercely debated question in Silicon Valley. Desire precedes experience for the lean startup crowd, thus founders are advised to follow Y Combinator’s motto: “Make something people want.” Others argue it is the technologist’s task to create innovations so good people couldn’t have imagined them, exemplified by Steve Jobs’s famous line “People don’t know what they want until you show it to them.”

Atomic transactions offer a reconciliation to this question: user demand can be known ahead of time for technologies reducible to atomic transactions. When comparing the atomic transactions of air taxis, helicopters, and Ubers, skepticism about air taxi demand is reasonable—even if they operate flawlessly—given the constraints of airport-heliport routes, high per-seat costs, and questionable time savings. Yet, when applications cannot be simplified into limited, discrete mappings, we should be humble about the limits of our rationality. Else, one risks playing a fool.

Secondly, I must clarify this essay’s purpose is to provide an analytical tool, to help technologists become more pragmatic in what they choose to build and fund. It is by no means an absolute critique of any particular field or the brave souls trying to advance them. 2024 will mark the 50th birthday of Joby’s founder and the 19th anniversary since Joby’s founding. This is truly hard work that demands respect and patient capital.

Progress in so many fields, including quantum computing, hypersonic travel, and all the “unpragmatic” fields mentioned earlier have only been sustained because of futurisms too easily dismissed as “irrational.” If these technologies eventually become reality, past failures will have played an indispensable role in informing their success.

It would be cruel to wish anyone to lose their time and money building futile technologies. Yet, I dread the day we no longer produce narratives that inspire deep idealism about the future. One cannot have one without the other. Technological progress is the sum of many failed dreams and a few successful ones.

Many thanks to Darren Zhu, Willy Chertman, Conor Robbins, Cody Retherford, AJ Kourabi, Lacey Strahm, Moksh Jawa, and Brandon Liu for their thoughts and feedback on this piece.

Thank you for writing this piece.

I wonder if there's a systematic reason why deep tech companies fail to focus on the atomic transactions. I argue that it is rooted in how VC and the startup ecosystems chooses who to back in join: that we overvalue technological differentiation. We assume extrapolate technologies to their full maturities and use that to absolve any architectural sins.

For example consider Relativity, I think that investors and early stage employees were eager to find "the next SpaceX", and people extrapolated their 3d printing technology to full maturity, and let it blind themselves from the atomic transactions at heart: no one cares how you build a rocket, they merely ask to minimize kg/$ to orbit. And what held SpaceX back was never the structural iterations.

Specifically pulling apart the Relativity example, I cannot comment how the investment was actually made, but I suspect the 3D printed rockets component was definitely overstressed in pitch decks and hiring calls.

I am not saying that 3D printed rockets are snake oil, or that any company pitching with high technology risk is flawed, and thus they are the fools. But rather that we as investors and employees perpetuate cases of overestimation. By allowing ourselves to hype up startups and industries on shaking footing, either through eagerness to invest in the industry as a whole or through lack of understanding, we allow some companies to slip through the cracks: to let them center on technology, not transactions empowered by technology.

I argue that the myopia plaguing deep-tech startups is not only from their founders and teams, but also the broader investment community, journalism, and early stage employees.

I have a hard time drawing the line between a hater and a constructive critic of companies who are pushing things that the market has no home for. But perhaps if there were a better discourse around "ayo bro I think you're solving a good problem, but don't you think you can do it without using magnetic levitating trinkets" --- then maybe there would be more space to draw the line.

Thank you Kevin for dissecting this space! I think we need to be more active in discussing "is this really the best use of 10 bright engineers' time?"

Do you know if any of the air taxi startups tried pivoting to catering to commerce instead of passengers? I feel like there would be fewer regulatory hurdles (mainly regarding safety) and the economics there would be slightly better, especially in high traffic, high population density areas. For example, maybe there could be some use case where Amazon Prime is trying to move a bunch of stuff from warehouse to warehouse.